Maximum borrowing mortgage

The couple with a young child were first approved for a mortgage of around 975000 in late 2021 and then again when they went back for pre-approval earlier this year. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

. 636a as added by section 1102. This directly correlates with term length eligibility. Student Finance in 30 seconds.

Get 247 customer support help when you place a homework help service order with us. Secured by your principal residence. If youre applying for a mortgage jointly with someone else lenders will use your combined incomes to determine how much you can borrow which usually works out to much more than either applicant could afford on their own.

Mortgage loans generally have a maximum term that is the number of years after which an amortizing loan will be repaid. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding. The rates also assume no or very low.

Second mortgage types Lump sum. Based on our Flexible home loan with Member Package option annual fee 395 which currently offers a 369 pa. Variable rate 1 472 pa.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. Daily Treasury PAR Yield Curve Rates This par yield curve which relates the par yield on a security to its time to maturity is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. Or Enroll In Online Banking.

However gross borrowing costs are substantially higher than the nominal interest rate and amounted for the last 30 years to 1046 per cent. The maximum loan for those borrowing 95 per cent LTV will remain at 500000. Remember User ID You have the maximum number of saved User IDs 3 Forgot ID or Password.

See Developer Notice on February 2022 changes to XML data feeds. The Student Finance package includes a loan for course fees plus a means-tested Maintenance Loan or Grant to cover living costs. 2 the term covered mortgage obligation means any indebtedness or debt instrument incurred in the ordinary course of business that-- A is a.

Get all the latest India news ipo bse business news commodity only on Moneycontrol. As of 2004 reached about 6 per cent per annum. A home equity loan term can range.

And the APR or points and fees charged exceed certain threshold amounts that are tied to. How much can I borrow. Think of it as a maximum borrowing power calculator helping you work out what a bank takes into consideration to ensure you could repay your home loan and meet your other outgoings.

Ranges and eligibility may vary based on loan details consult a Mortgage Loan Officer for additional information. Joint mortgage borrowing. Maximum mortgage term length for retired borrowers As established many UK lenders have age limits for mortgage lending.

Student Finance funded by the government helps students from any financial background to go to university. Rocket Mortgage LLC is not affiliated with The Charles Schwab Corporation Charles Schwab Co Inc. Lenders mortgage insurance is an insurance cover that protects a lender if you cant meet required mortgage repayments and default on your loan.

Thats when Australias. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Jumbo mortgages can be used to refinance a home up to 80 of the home value. Second mortgages come in two main forms home equity loans and home equity lines of credit. Annual mortgage insurance premium.

Find the right home mortgage loan option based on loan terms down payment more. The par yields are derived from input market prices. Based on these criteria undergraduates can borrow a maximum of 9500 to 12500 annually and 57500 total.

Sign On to Mobile Banking. Federal Student Aid. If you choose.

Interest rates for a home equity loan are typically lower than interest rates for credit cards or unsecured personal loans. PNC Bank offers mortgage loan options to help make home buying easier. Graduate students can borrow up to 20500 annually and 138500 total which includes.

You could potentially in some circumstances borrow up to a maximum of 90 of the value of your home. At 85 per cent LTV the maximum loan size has gone from 750000 to 15m and at 90 per cent LTV the maximum loan size has increased from 500000 to 750000. Comparison rate 2This assumes 1 a loan that is for owner occupier purposes with principal and interest repayments 2 a loan amount of more than 400k but less than 700k and 3 where the amount borrowed is more than 70 but not.

Lower borrowing costs. 30 years the loan amount and the initial loan-to-value ratio or LTV. Borrow more on your Royal Bank of Scotland residential mortgage to help realise your plans for those home improvements dream holiday etc.

If youre eligible for an FHA Streamline Refinance there is no loan-to-value maximum and an appraisal may not be necessary. Start borrowing with only 2000 in cash or marginable securities¹. Universities can charge up to 9250 a year in tuition fees but youll pay nothing upfront.

Or Charles Schwab Bank SSB. Of course this depends on both parties circumstances and the addition of an applicant. A high-cost mortgage is a mortgage used to buy a home a home equity loan or second mortgage or refinance or a HELOC that is.

One of these caps is a maximum age for taking out a new mortgage typically between age 65 - 70 and another for paying them off usually between ages 80 - 85. Deposit and other lending products are offered by Charles Schwab Bank SSB Member FDIC and Equal Housing Lender. 045 percent to 105 percent depending on the loan term 15 years vs.

HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and. A Definitions--In this section-- 1 the term covered loan means a loan guaranteed under paragraph 36 of section 7a of the Small Business Act 15 USC. In Denmark similar to.

Fha Jumbo Loans In 2022

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

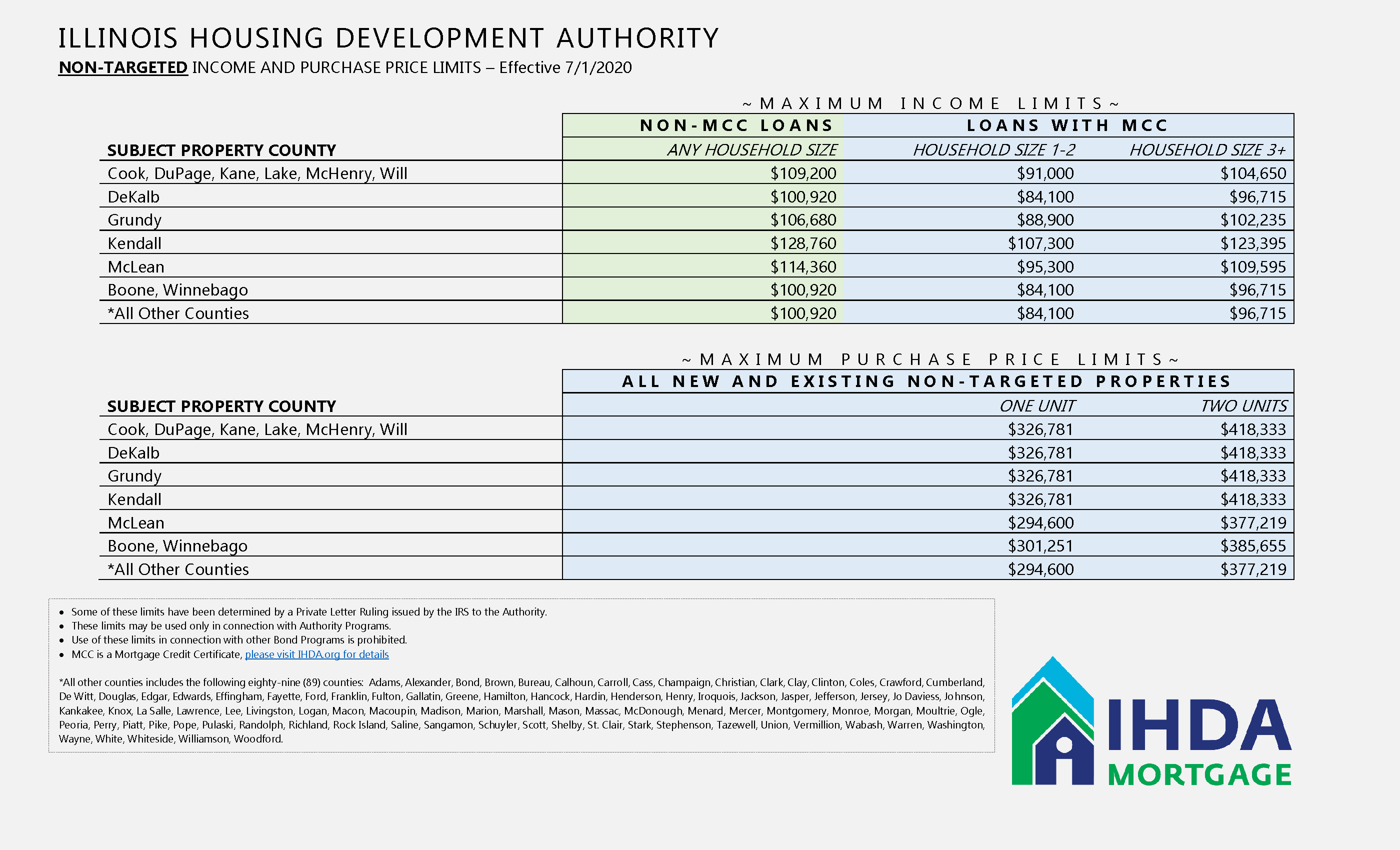

Income And Purchase Price Limits Ihda

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

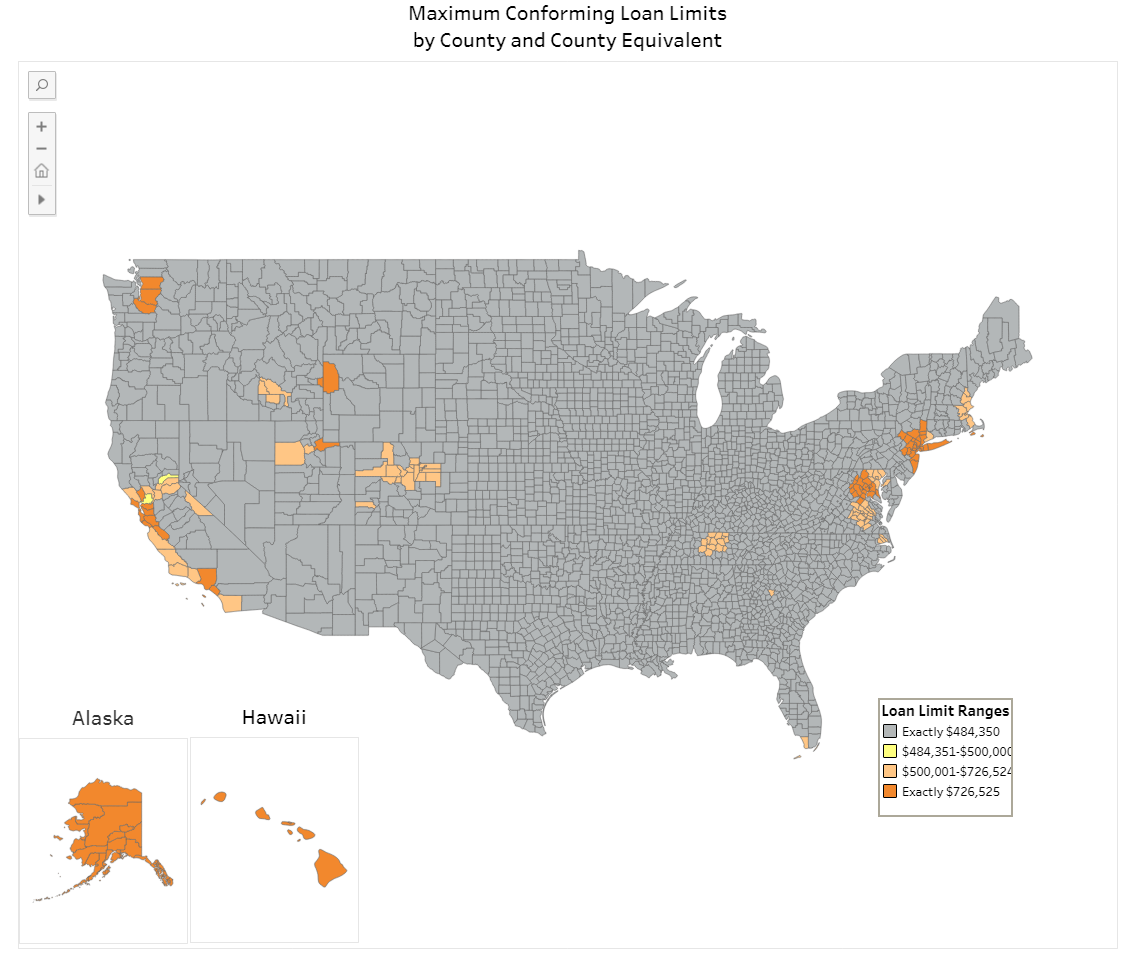

Loan Limits 2022 Mortgagedepot

Excel Formula Calculate Original Loan Amount Exceljet

Student Loan Limits How Much Can You Borrow Penfed Credit Union

Va Loan Limits For High Cost Counties Updated For 2021 Military Com

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

Conforming Loan Limits Conventional Home Loans Ally

Determine A Max Home Loan Given A Monthly Payment Formula Youtube

How Much Is The Maximum Student Loan Amount You Can Borrow Student Loan Hero

Fha Loan What To Know Nerdwallet

2022 Fha Loan Lending Limits

2022 Jumbo Loan Limits Ally

/federal-direct-loans-subsidized-vs-unsubsidized-Final-f0f41bb91a7143fbb1657b8d352c6ae7.png)

Subsidized Vs Unsubsidized Student Loans Which Is Best

Va Loan Calculator